All Categories

Featured

[/video]

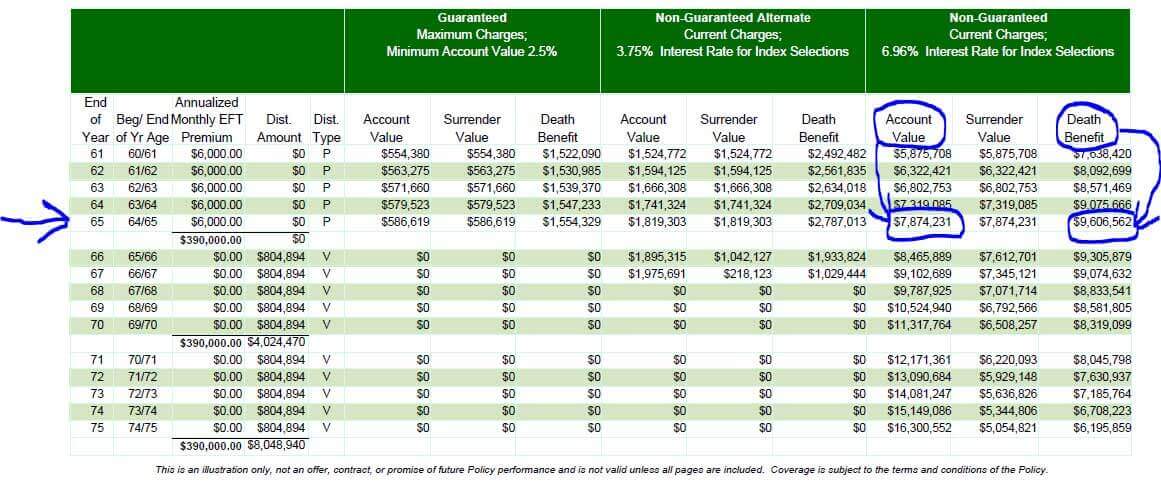

Withdrawals from the cash value of an IUL are commonly tax-free up to the quantity of costs paid. Any type of withdrawals above this quantity may go through tax obligations relying on policy structure. Conventional 401(k) payments are made with pre-tax dollars, minimizing gross income in the year of the payment. Roth 401(k) contributions (a plan function offered in a lot of 401(k) plans) are made with after-tax contributions and afterwards can be accessed (revenues and all) tax-free in retired life.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for a minimum of 5 years and the person mores than 59. Possessions taken out from a standard or Roth 401(k) before age 59 may sustain a 10% charge. Not exactly The cases that IULs can be your very own financial institution are an oversimplification and can be deceiving for many factors.

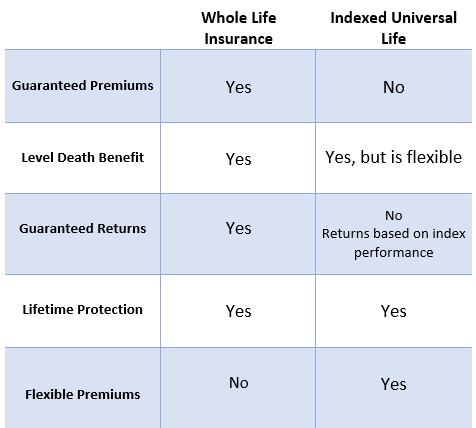

Nonetheless, you might go through upgrading connected wellness concerns that can affect your continuous costs. With a 401(k), the money is constantly your own, consisting of vested employer matching despite whether you quit contributing. Risk and Warranties: Primarily, IUL policies, and the cash money worth, are not FDIC insured like standard checking account.

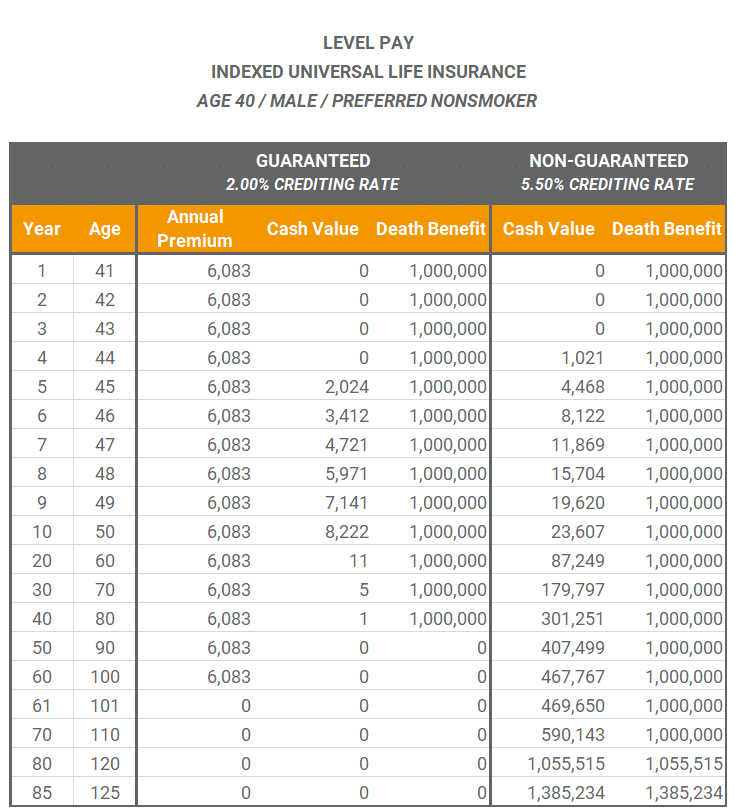

While there is commonly a floor to avoid losses, the growth potential is covered (indicating you might not totally benefit from market upswings). A lot of specialists will certainly agree that these are not comparable products. If you desire survivor benefit for your survivor and are concerned your retirement cost savings will not suffice, after that you might intend to consider an IUL or other life insurance coverage item.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Sure, the IUL can provide access to a cash money account, but once again this is not the main purpose of the product. Whether you want or need an IUL is a very specific inquiry and depends upon your key economic purpose and objectives. Below we will certainly try to cover advantages and restrictions for an IUL and a 401(k), so you can even more define these products and make a much more educated choice concerning the finest method to take care of retired life and taking care of your liked ones after death.

Iul Tax Free Income

Financing Costs: Financings against the plan accrue rate of interest and, if not settled, lower the fatality benefit that is paid to the recipient. Market Participation Restrictions: For most plans, investment development is tied to a stock exchange index, but gains are normally capped, limiting upside potential - index universal life insurance companies. Sales Practices: These policies are usually marketed by insurance agents that may emphasize advantages without fully explaining prices and threats

While some social media experts suggest an IUL is a replacement product for a 401(k), it is not. These are various products with various objectives, features, and prices. Indexed Universal Life (IUL) is a kind of irreversible life insurance plan that also provides a cash money worth component. The cash money value can be made use of for numerous objectives consisting of retired life cost savings, extra income, and other financial needs.

Latest Posts

What Is Indexed Universal Life Insurance

Iul Life Insurance Vs Whole Life

Single Premium Indexed Universal Life Insurance